Archive for the ‘Organizational Strategy’ Category

What constitutes a “full-service” Equities business?

[Part 4 of Equities Context and Content]

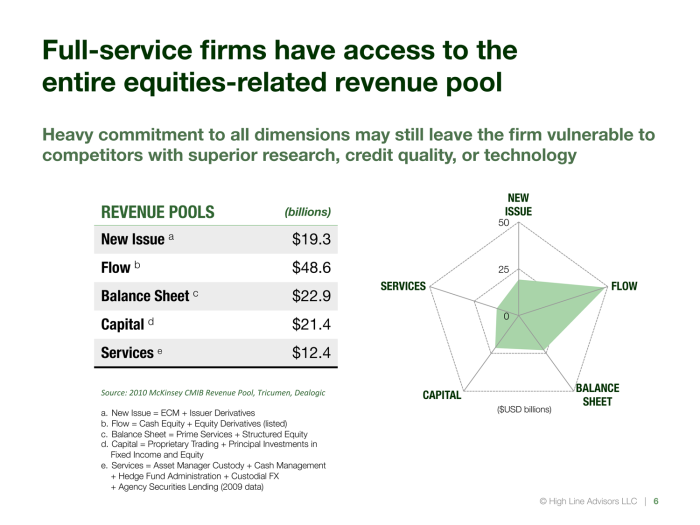

Mature Equities businesses offer a complete array of products and services under the umbrella of Equities. The full-service Equities model incorporates five diversified business lines, each of which has a set of products and services that capture revenue in various forms:

- NEW ISSUE

Origination business based on corporate relationships, resulting in direct underwriting and placement fees and indirect revenues from investor clients seeking to participate in their allocation. Examples include: common and preferred equity, convertible bonds, and private placements. - FLOW

Agency risk transfer business resulting in commissions and the potential for reduced expenses due to internalization. Examples include: “high-touch” and/or electronic order handling in cash equities and listed derivatives. - BALANCE SHEET

Financing businesses resulting in accrual of spreads in excess of cost of funding. Examples include: prime brokerage, securities lending, repo, and OTC derivatives. - CAPITAL

Principal trading businesses, including market-making and client facilitation, resulting in revenues from bid/offer spreads and directional risk-taking. Examples include: underwriting, block trading, aspects of program trading, listed options market-making, and certain proprietary trading strategies. - SERVICES

Low-risk, operationally-intensive agency business resulting in fee income tied to balances or transactions. Examples include: custody, administration, cash and collateral management.

A comprehensive offering allows such firms to compete globally for all client segments and to address the entire available revenue pool. As shown in Table 2, McKinsey estimates the global revenues that may be directly linked to Equities at over $120 billion in 2010.

Figure 2 illustrates the five Equities business lines in a way that circumscribes the revenue pool:

Diversification can reduce earnings volatility and reliance on new issue activity. Of the five dimensions, flow commissions in cash and derivatives account for 39% of the pool, a fact that leads all competing firms to focus on execution capability. With more than twice as much revenue at stake overall, diversified firms not only access the related pools, but may also have an advantage competing for flow.

The capabilities or limitations of a larger firm directly impacts the ability of its Equities business to compete in each of the five dimensions. For example, the firm’s ability to allocate balance sheet and capital to its Equities business allows Equities to offer financing products or to carry inventory in convertible bonds. Similarly, Corporate Banking could drive new issue supply through the Equities business via its capital markets efforts.

Why does the firm context matter?

[Part 3 of Equities Context and Content]

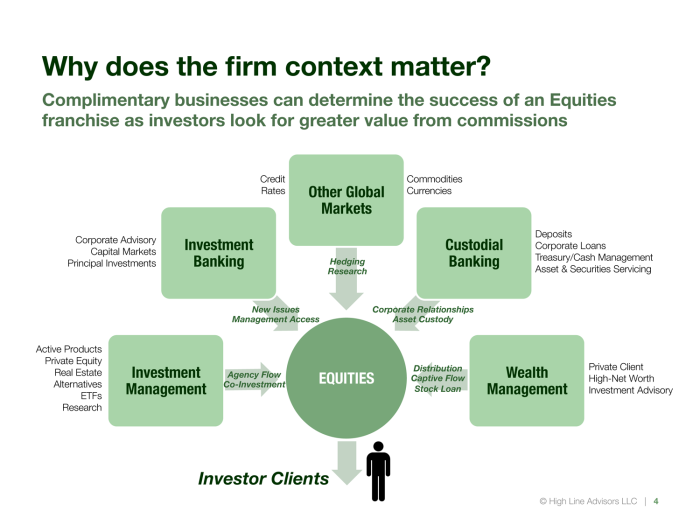

There are five bank or broker-dealer businesses that can significantly enhance a firm’s Equities business. The capabilities and resources “owned” by these other business units can provide a competitive advantage in attracting equity investors:

- CORPORATE BANKING

Direct lending and corporate finance can produce two of the resources most valued by investors: new issues and access to corporate management. The Equities business can in turn provide market color on previously-issued equities and related derivatives to bankers and their corporate clients, earning mandates for share repurchases and block trades. The two business units can also share the cost of Research within applicable regulatory limitations. - PRIVATE WEALTH MANAGEMENT

Retail can be a powerful contributor to an Equities business through the direction of order flow and stock loan balances. A captive source of liquidity and commissions provides a boost to the sales and trading unit, and a unique supply of hard-to-borrow securities can differentiate the prime brokerage unit. A retail distribution network may be viewed favorably by both corporate clients awarding new issues and block trades, and asset managers seeking capital. - TRADING IN OTHER GLOBAL MARKETS ASSET CLASSES

Trading capabilities in complimentary asset classes can provide research, market color, and occasional trade facilitation for equity investors. Single-name credit products such as corporate bonds and credit default swaps can provide investors with deeper insight into corporate capital structures. Index, currency, and rate products offer investors a means to hedge macro exposures in their portfolios. Commodities trading expertise can also provide macro insights as well as deeper understanding of companies in the energy, agriculture, and metals sectors. Broader trading capabilities can provide solutions for cash and liquidity management in repo, government securities, and corporate commercial paper. - CUSTODIAL/TRANSACTION BANKING

Custodial Banking can strengthen relationships with both corporate and investor clients. On the corporate side, credit lines, treasury services, cash management, and payments processing can lead to increased access to management and participation in new issues. On the investor side, clearing, collateral management, custody, securities services, and fund administration can result in operational dependencies between the firm and its investor clients. Banks with a deposit base may enjoy a higher credit rating, thereby enhancing the ability of an Equity business to compete in prime brokerage and over-the-counter derivatives. - ASSET MANAGEMENT

There are a number of regulatory constraints and perceived conflicts that weigh on the synergies between an Equities trading business and a related Asset Management subsidiary; however, a percentage of agency order flow from the Asset Management arm may be directed to the Equities business, and access to stock loan supply can support its prime brokerage and derivatives trading efforts. Partnership in the creation of equity-linked ETFs and structured notes can generate product supply for retail and wholesale investors. Apart from trading, Asset Management provides a means to monetize Research, in some cases alongside of investor clients.

Figure 1 illustrates some of the contributions of these five business units to the traditional business of Equities and its clients:

Clients care about what a bank or broker-dealer can do for them overall, without concerning themselves with a firm’s internal product boundaries or management organization. When broader capabilities are called for, collaboration with other internal business units becomes critical to the success of the Equities franchise.

Streamlining Equities

High Line Advisors has published an article entitled Streamlining Equities: Ten Operating Strategies for Competing in Today’s Markets. A PDF of the article is available here.

“Whosoever desires constant success must change his conduct with the times.” — Niccolo Machiavelli

Article at a Glance

Equity sales and trading (“Equities”) is a core business for many banks and broker-dealers, on its own merits and because of its synergies with corporate banking and wealth management. Like all capital markets businesses, Equities under increasing pressure from electronic trading, reduced leverage, increased capital requirements, regulation of over-the-counter derivatives, and limitations on proprietary trading.

New operating conditions call for a leaner operating model to protect revenue and maintain growth, starting with a reevaluation of the product silos that require so many specialists. Profitability also depends on the firm’s ability to deliver resources to clients and capture trades with greater efficiency. Success requires re-thinking the entire legacy organization, looking at new ways to combine or expand roles, and reevaluating the skills that are needed on the team.

These ten initiatives in sales, trading, and operations, can help management streamline the Equities organization for greater top line revenue and increased operating leverage:

- Recast “Research Sales” for delivery of all products and firm resources

- Create “Execution Sales” to maximize trade capture across products

- Rebalance Coverage Assignments to foster team selling for client wallet capture

- Fortify Multi-Product Marketing to maximize product penetration and client wallet share

- Deploy Sector Specialists to generate alpha and raise internal market intelligence

- Implement a Central Risk Desk to consolidate position management and client coverage

- Merge Secured Funding Activity to manage collateral funding and risk

- Centralize Structured Products to eliminate redundancy and internal conflict

- Reengineer Client Integration for speed and control of non-market risks

- Normalize Client Service to eliminate duplicate processes and improve client experience

Collateral Management: Best Practices for Broker-Dealers

High Line Advisors has published an article entitled Collateral Management: Best Practices for Broker-Dealers. A PDF of the article is available here.

col•lat•er•al (noun)

something pledged as security for repayment of a loan, to be forfeited in the event of a default.col•lat•er•al dam•age (noun)

used euphemistically to refer to inadvertent casualties among civilians and destruction in civilian areas in the course of military operations. — Oxford American Dictionary

Article at a Glance

Stand-alone broker-dealers, as well as those operating within banks and bank holding companies, face increasing pressure to minimize costs and balance sheet footprint. Collateral management is a set of processes that optimize the use and funding of securities on the balance sheet. For a broker-dealer, sources of collateral include securities purchased outright, as risk positions or derivatives hedges, and securities borrowed. Additional securities are obtained through rehypothecation of customer assets pledged in principal transactions such as repurchase agreements (repo), margin loans, and over-the-counter (OTC) derivatives. This pool of securities is deployed throughout the trading day. At the close of trading, the remaining securities become collateral in a new set of transactions used to raise the cash needed to carry the positions. Poor collateral management leads to excessive operating costs, and, in the extreme, insolvency.

A disciplined trading operation aims to be “self-funding” by borrowing the cash needed to run the business in the secured funding markets rather than relying on corporate treasury and expensive, unsecured sources such as commercial paper and long-term debt. The funding transaction may be with other customers, dealers, or money market funds via tripartite repo. Careful management of the settlement cycle for various transactions allows a broker-dealer to finance the purchase of a security by simultaneously entering into a repo, loan, or swap on the same security or other collateral.

Many aspects of secured funding and collateral management are common to all trading desks. A centralized and coordinated collateral management function supports the implementation of several best practices and provides transparency for control groups and regulators. Regulation and increased dealings with central counterparty clearing arrangements will soon increase capital and cash requirements imposed on broker-dealers. Even in advance of such changes, customers are placing restrictions on the disposition of their assets and limitations on the access granted to broker-dealers. This trend makes it more critical for dealers to optimize their remaining sources of funding.

Note that the prime brokerage area of a bank or broker-dealer is in the best position to manage the collateral pool as a utility on behalf of the entire global markets trading operation. For more detail, see “The Future of Prime Brokerage,” High Line Advisors LLC, 2010. Figure 1 from the article is provided below. A print-quality PDF may be downloaded from our website here.

Hedge Fund Coverage

Our recent post on Team Selling as an alternative to cross-selling prompts a larger series on hedge fund coverage. In future blog posts, we will provide some proven techniques for managing complex institutional investor clients across multiple product areas of a bank or broker-dealer. While these techniques have been applied successfully in a global institutional equity business, they may be extended to fixed income or other multi-product businesses that serve the same client.

UPDATE: High Line Advisors has published an article on this topic. Hedge Fund Coverage: Managing Clients Across Multiple Products is available upon request.

“Team Selling” Over “Cross-Selling”

[part of a series on hedge fund sales coverage]

“Cross-selling” initiatives have always struck us as weak efforts to encourage client-centric behavior in essentially product-centric organizations. Incentives often work against the intent, as sales professionals understand their compensation to be driven by revenues in one product line, and annual bonus discussions fail to reinforce broader behavior.

Most broker-dealers are organized by product. The best aspects of product-centric management are risk discipline, operating efficiency, domain expertise, best-of-breed products, and an excellent client experience. Product-centric management works well when there is a 1:1 relationship between clients and products, as was the case historically. Modern asset managers, hedge funds in particular, are not so well-behaved, and may deploy many products or asset classes within a single portfolio. Without a means of communicating horizontally, product-centric organizations can miss overall client activity and related revenue.

What is needed is an approach to balance product discipline with client coverage across multiple products. This requires a “1:many” solution for covering clients and measuring revenue across products. We call the process of coordinating sales coverage of one client across multiple products “Team Selling.” The team is collectively responsible for covering a client, and collectively responsible for maximizing share of the client’s “wallet,” rather than market share for any particular product.

Harvard Business Review recently conducted an interview with Admiral Thad Allen, USCG (Ret.) (ref. “You Have to Lead from Everywhere” by Scott Berinato). Admiral Allen’s comments on crisis management can be applied to the coordination of multiple product specialists in covering complex clients:

“You have to aggregate everybody’s capabilities to achieve a single purpose, taking into account the fact that they have distinct authorities and responsibilities. That’s creating unity of effort rather than unity of command, and it’s a much more complex management challenge.”

In the context of institutional sales, “unity of effort” implies coordination among separate individuals from different product areas covering the same client (or multiple buying centers at the same client institution), and the “single purpose” they are aiming to achieve is to maximize the profitability of that client.

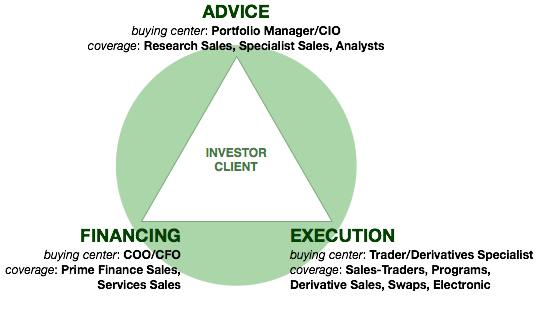

Using a hedge fund investing in long/short equity as an example, three buying centers can be defined by the investment decision (what to buy), the execution decision (how to buy or express the investment), and the financing decision (how to pay for it). In general, these decisions are made for the fund by different individuals or groups, with the portfolio manager, chief investment officer, or analyst consuming resources to determine what investments to make; the head trader or derivatives specialist deciding how orders are executed, and the chief operating officer or chief finance officer deciding how and where to source financing or borrow stock.

Traditionally, institutional equity sales teams have been comprised of Research Sales professionals covering buy-side analysts and portfolio managers, Sales-Traders and Derivatives Sales people covering buy-side trading desks, and Prime Brokerage or Stock Loan professionals covering the fund’s COO and CFO.

These client-facing professionals tend to be grouped by product, with Research Sales and Sales-Traders associated with cash, Derivatives Sales with derivatives, and Prime Brokerage and Stock Loan sales people associate with those financing products respectively. In a product-centric organization, these sales groups tend to focus on maximizing the revenue in their respective products, without regard for or regular communication with sales people in the other product silos, even if they cover the same institution.

Without breaking the product-centric organization, management can encourage coordination or “unity of effort” across product areas in covering the same client, simply by empowering teams with information on client revenue across all products, (in addition to the traditional reporting of product revenue across all clients). With the common goal of maximizing wallet share and profitability, a client team can work together to make introductions, deliver resources, solve client problems, and fill revenue gaps across the product spectrum.

While easily piloted, the first challenge in team selling is scalability. Scale is achieved when the same team of sales people from different product areas cover the same set of clients. When this occurs, the number of virtual teams can be fewer and their team meetings can be less frequent and more efficient. Rebalancing coverage assignments is difficult but can be rewarding over time: the organization can over a large number of clients as teams operate independently and simultaneously. Team selling is also a compliment to any key account management program, with team leaders corresponding to relationship or account managers. The larger the account, the more senior the team leader. Armed with the right information, anyone in the organization can contribute to or even lead a client team.

Culturally, teams must believe that they will be rewarded for overall increase in profitability of the clients they cover, not only the revenues in the product they are associated with. Client revenue production, product penetration, and profitability can be added to traditional sales metrics in the determination of compensation.

While cross-selling is a product-centric behavior that is by its nature a secondary priority for sales people, team selling encourages client-centric behavior and awareness of the maximum revenue opportunity from each client that the organization covers.

Learning From The Past

“A good scare is worth more to a man than good advice.” — Edgar Watson Howe

“That which does not kill us makes us stronger.” — Friedrich Nietzsche

- The self-liquidation of Amaranth Advisors at the end of 2006 was the canary in the coal mine, exposing the difficulty of managing complex customer activity in multiple markets and asset classes, expressed through listed products and OTC contracts in multiple legal entities. Firms had an inadequate picture of aggregate client activity and were uncertain of their contractual rights across the different products. This confusion slowed the movement of cash, creating cracks in the client-broker relationship. Losses at banks were averted solely because of the high degree of liquidity in Amaranth’s portfolio. The crucial question that would haunt banks in the coming months was: what if Amaranth’s remaining positions could not have been sold to raise cash?

- Several hedge funds, most notably those of Bear Stearns Asset Management, began to default on payments in 2007. Unable to raise cash from increasingly illiquid investments, both investors and banks lost money. The defaults drew attention to financing transactions in which the banks did not have sufficient collateral to cover loans they had extended. It is noteworthy that these trades were not governed by margin policy in prime brokerage, but were executed as repurchase agreements in fixed income, in some cases with no haircut or initial margin. Collateralized lending was practiced inconsistently by different divisions of the same firm, some ignoring collateral altogether and venturing into credit extension.

- The collapse and sale of the remainder of Bear Stearns in early 2008 highlighted a different liquidity problem: a case in which customer cash held in prime brokerage accounts (“free credits”) significantly exceeded the firm’s own cash position. Because of this imbalance, Bear Stearns was essentially undermined by its own clients as hedge funds withdrew their cash. Once the customer cash was gone, the firm could not replace it fast enough from secured or unsecured sources of its own. Bear Stearns’ predicament forced the prime brokerage industry to confront some hard truths: Because firms had developed a dependency on customer cash and securities in the management of their own balance sheets, sources of cash and their stability were not fully understood even by corporate treasuries.

- The bankruptcy of Lehman Brothers in September of 2008 exposed the widespread practice of financing an illiquid balance sheet in a decentralized manner with short-term liabilities. Under the assumption that the world was awash in liquidity and ready cash, many firms had neither the systems to manage daily cash balances nor contingencies in the event that short-term funding sources became scarce. The problems of Lehman and its investors were compounded by intra-company transfers and cash trapped in various legal entities.

- The Madoff scandal that broke the following December was in some ways the last straw for asset owners. Already concerned about the health of the banking system and the idiosyncratic risk of fund selection, they lost confidence in the industry’s infrastructure and controls. Banks now contend with demand for greater asset protection and transparency of information.

In summary, the actions suggested by these five events are as follows:

- Aggregate the activities of any one client across all products and legal entities of the bank or broker-dealer

- Establish consistent secured lending guidelines across similar products to ensure liquidity

- Develop transparency of all sources and uses of cash to minimize reliance on unsecured funding [see Collateral Management: Best Practices for Broker-Dealers]

- Match assets and liabilities to term

- Prepare for segregation of customer collateral with operations, reporting, and alternative funding sources

The “Clearing” Broker vs. The “Prime” Broker

We are often questioned on the definition of “prime brokerage.” The various names by which banks and broker-dealers label a collection of products and services (prime services, prime finance, equity financing and services, etc.) hint at the fact that there is little consistency among market participants. The scope of such business units variously includes or excludes execution, clearing, and/or financing of physical securities (equity and fixed income), OTC derivatives, and listed futures and options. Inconsistency makes it difficult for regulators to measure and for managers to benchmark themselves to competitors.

In the article entitled The Future of Prime Brokerage, we suggested that prime brokerage could be defined as the center of both client service and secured funding for a bank or broker-dealer. With stock loan, margin lending, and total return swaps all essentially exchanging equity securities for cash or vice-versa, consolidating the management of these secured funding transactions (along with equity repo, forwards, and high-delta options and option combinations) minimizes risks and optimizes the balance sheet. We also suggested that this concept can be extended beyond the equity asset class into liquid fixed income securities that are financed via comparable instruments (usually repo).

We also argued that prime brokerage can be the consolidation point for client activity across the bank or broker-dealer, thereby facilitating reporting, portfolio-level financing, and consolidated margin. In so doing, prime brokerage provides the single point of post-trade client service for all institutional investors.

Prime brokers generally do the clearing for trades that they accept from executing brokers on behalf of their clients. The scope of the prime brokerage relationship is defined by the set of products that the prime broker can clear. At a minimum, prime brokers clear cash equity trades themselves (“self-clearing”) rather than relying on a correspondent. Many prime brokers also accept listed equity derivatives, which gives their clients more flexibility and convenience. Some primes (such as NewEdge) emphasize clearing of listed derivatives.

The enactment of the Dodd-Frank legislation in the US has brought focus on the clearing of listed derivatives. The management of listed futures and options clearing within banks and broker-dealers varies, which may affect the product scope of the prime brokerage offering at a bank or broker-dealer:

- Alignment with institutional equities builds on the core knowledge of exchange mechanics and electronic trading in the equities business;

- fragmentation by asset class puts profit and loss from various contracts into the related product area, e.g. revenue from interest rate futures booked into the rates business and from equity index futures into the equities business;

- management as a stand-alone business line (including execution and clearing) due to the unique nature of listed derivatives and their risk and collateral requirements over the life of the contracts;

- alignment with traditional prime brokerage businesses, for management of portfolios using listed derivatives for risk mitigation and serving firms who borrow securities and cash in support of market-making activities.

As banks and broker-dealers seek to optimize their respective balance sheets and capital requirements, just as institutional investors will seek portfolio-level margin and consolidated service and reporting, the distinction between the “prime” broker and the “clearing” broker may vanish. With more products moving to exchanges or central counterparties (CCPs), centralized optimization of the bank or broker-dealer’s funding in the context of CCP requirements and heightened controls over customer collateral is critical.

We advocate the management of clearing activity for all trading products within the prime brokerage or prime “services” operation. The definition of “prime brokerage” then extends to three specific utilities across global markets:

- Securities finance

- Client service

- Clearing

Of these functions, securities finance compliments a sales and trading (execution) business in the related securities, usually equities. Similarly, clearing compliments an execution business in listed derivatives. Among various banks and broker-dealers globally, players may emphasize one or the other, or both lines of business. For example, European banks operating in the US may be significant players in listed derivatives but not in cash equities, favoring a prime brokerage business built on clearing. Smaller broker-dealers may deal in cash equities but not derivatives. With a smaller balance sheet, such broker-dealers may emphasize the client service aspect of prime brokerage and source financing for their customers in the wholesale markets. The largest banks may have the largest scope, serving clients active in cash as well as derivatives, from execution through to clearing and custody.

When should execution as well as clearing, custody, and secured financing be a part of prime brokerage? We would suggest that when financing of an asset is the primary component of setting price (spread) and margin (haircuts), then the execution component of the product is a candidate for integration with prime brokerage in order to apply common practices for secured lending transactions. Incorporation of execution functions may be difficult for prime brokerage businesses built on post-trade margin financing, just as it may be difficult for fixed income repo or equity derivatives trading desks to appreciate the commonalities of their products with margin and securities lending.

If prime brokerage is used as a firm-wide utility and not as part of a product silo, broader linkages to execution services (defined by electronic trading tools, exchange connectivity, and clearing) allow for straight-through-processing and better operating leverage for banks and broker-dealers. By increasing the number of products that a covered by clearing, financing, and reporting, the prime broker will have a more complete value proposition for asset managers and a greater ability to manage collateral and risk exposures.

A final note on the distinction between the clearing “function” and the clearing “platforms” at a bank or broker-dealer. The clearing “function” is performed on behalf of trading clients and may require financing (the lending of cash and/or securities) to facilitate settlement, either of which are a natural fit within prime brokerage. The clearing “platforms” are the technologies on which the clearing is done. The management (maintenance and operations) of the platforms may be performed outside of prime brokerage, such as within the GTS business of Citi, or the TTS business of JP Morgan. In these instances, the platforms may be used by the firm’s own global markets businesses as well as offered to the firm’s other clients, who may be broker-dealers themselves.

The Future of Prime Brokerage

HLA has published an article defining prime brokerage as a center of secured funding and client service for banks and broker-dealers. A PDF is available here.

Read the rest of this entry »