Posts Tagged ‘derivatives’

What constitutes a “full-service” Equities business?

[Part 4 of Equities Context and Content]

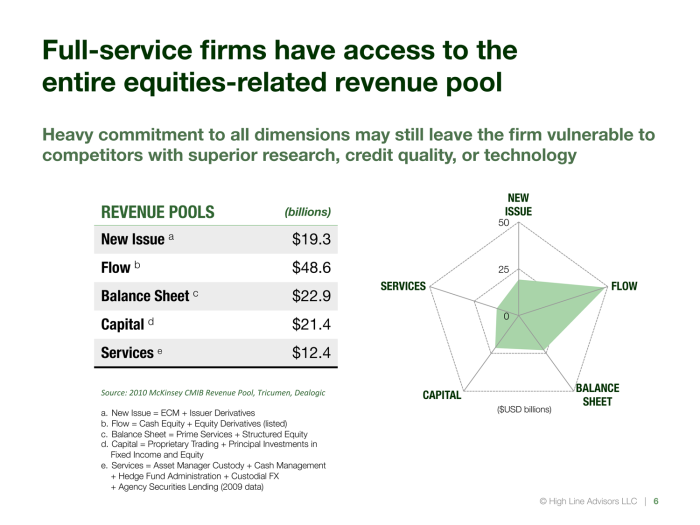

Mature Equities businesses offer a complete array of products and services under the umbrella of Equities. The full-service Equities model incorporates five diversified business lines, each of which has a set of products and services that capture revenue in various forms:

- NEW ISSUE

Origination business based on corporate relationships, resulting in direct underwriting and placement fees and indirect revenues from investor clients seeking to participate in their allocation. Examples include: common and preferred equity, convertible bonds, and private placements. - FLOW

Agency risk transfer business resulting in commissions and the potential for reduced expenses due to internalization. Examples include: “high-touch” and/or electronic order handling in cash equities and listed derivatives. - BALANCE SHEET

Financing businesses resulting in accrual of spreads in excess of cost of funding. Examples include: prime brokerage, securities lending, repo, and OTC derivatives. - CAPITAL

Principal trading businesses, including market-making and client facilitation, resulting in revenues from bid/offer spreads and directional risk-taking. Examples include: underwriting, block trading, aspects of program trading, listed options market-making, and certain proprietary trading strategies. - SERVICES

Low-risk, operationally-intensive agency business resulting in fee income tied to balances or transactions. Examples include: custody, administration, cash and collateral management.

A comprehensive offering allows such firms to compete globally for all client segments and to address the entire available revenue pool. As shown in Table 2, McKinsey estimates the global revenues that may be directly linked to Equities at over $120 billion in 2010.

Figure 2 illustrates the five Equities business lines in a way that circumscribes the revenue pool:

Diversification can reduce earnings volatility and reliance on new issue activity. Of the five dimensions, flow commissions in cash and derivatives account for 39% of the pool, a fact that leads all competing firms to focus on execution capability. With more than twice as much revenue at stake overall, diversified firms not only access the related pools, but may also have an advantage competing for flow.

The capabilities or limitations of a larger firm directly impacts the ability of its Equities business to compete in each of the five dimensions. For example, the firm’s ability to allocate balance sheet and capital to its Equities business allows Equities to offer financing products or to carry inventory in convertible bonds. Similarly, Corporate Banking could drive new issue supply through the Equities business via its capital markets efforts.

Why does the firm context matter?

[Part 3 of Equities Context and Content]

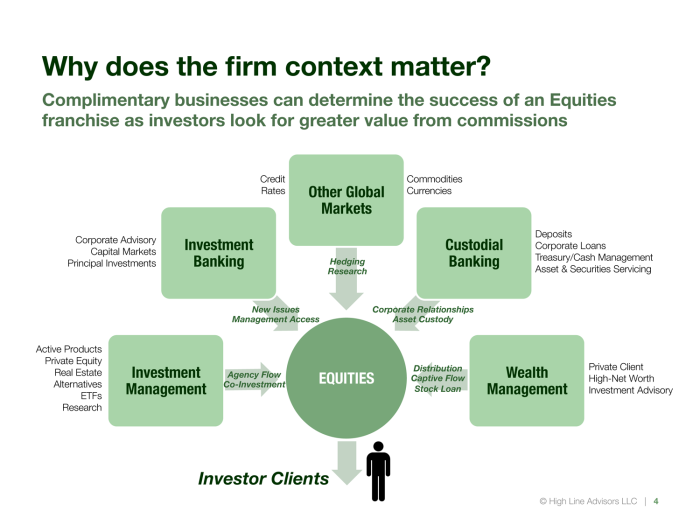

There are five bank or broker-dealer businesses that can significantly enhance a firm’s Equities business. The capabilities and resources “owned” by these other business units can provide a competitive advantage in attracting equity investors:

- CORPORATE BANKING

Direct lending and corporate finance can produce two of the resources most valued by investors: new issues and access to corporate management. The Equities business can in turn provide market color on previously-issued equities and related derivatives to bankers and their corporate clients, earning mandates for share repurchases and block trades. The two business units can also share the cost of Research within applicable regulatory limitations. - PRIVATE WEALTH MANAGEMENT

Retail can be a powerful contributor to an Equities business through the direction of order flow and stock loan balances. A captive source of liquidity and commissions provides a boost to the sales and trading unit, and a unique supply of hard-to-borrow securities can differentiate the prime brokerage unit. A retail distribution network may be viewed favorably by both corporate clients awarding new issues and block trades, and asset managers seeking capital. - TRADING IN OTHER GLOBAL MARKETS ASSET CLASSES

Trading capabilities in complimentary asset classes can provide research, market color, and occasional trade facilitation for equity investors. Single-name credit products such as corporate bonds and credit default swaps can provide investors with deeper insight into corporate capital structures. Index, currency, and rate products offer investors a means to hedge macro exposures in their portfolios. Commodities trading expertise can also provide macro insights as well as deeper understanding of companies in the energy, agriculture, and metals sectors. Broader trading capabilities can provide solutions for cash and liquidity management in repo, government securities, and corporate commercial paper. - CUSTODIAL/TRANSACTION BANKING

Custodial Banking can strengthen relationships with both corporate and investor clients. On the corporate side, credit lines, treasury services, cash management, and payments processing can lead to increased access to management and participation in new issues. On the investor side, clearing, collateral management, custody, securities services, and fund administration can result in operational dependencies between the firm and its investor clients. Banks with a deposit base may enjoy a higher credit rating, thereby enhancing the ability of an Equity business to compete in prime brokerage and over-the-counter derivatives. - ASSET MANAGEMENT

There are a number of regulatory constraints and perceived conflicts that weigh on the synergies between an Equities trading business and a related Asset Management subsidiary; however, a percentage of agency order flow from the Asset Management arm may be directed to the Equities business, and access to stock loan supply can support its prime brokerage and derivatives trading efforts. Partnership in the creation of equity-linked ETFs and structured notes can generate product supply for retail and wholesale investors. Apart from trading, Asset Management provides a means to monetize Research, in some cases alongside of investor clients.

Figure 1 illustrates some of the contributions of these five business units to the traditional business of Equities and its clients:

Clients care about what a bank or broker-dealer can do for them overall, without concerning themselves with a firm’s internal product boundaries or management organization. When broader capabilities are called for, collaboration with other internal business units becomes critical to the success of the Equities franchise.

Streamlining Equities

High Line Advisors has published an article entitled Streamlining Equities: Ten Operating Strategies for Competing in Today’s Markets. A PDF of the article is available here.

“Whosoever desires constant success must change his conduct with the times.” — Niccolo Machiavelli

Article at a Glance

Equity sales and trading (“Equities”) is a core business for many banks and broker-dealers, on its own merits and because of its synergies with corporate banking and wealth management. Like all capital markets businesses, Equities under increasing pressure from electronic trading, reduced leverage, increased capital requirements, regulation of over-the-counter derivatives, and limitations on proprietary trading.

New operating conditions call for a leaner operating model to protect revenue and maintain growth, starting with a reevaluation of the product silos that require so many specialists. Profitability also depends on the firm’s ability to deliver resources to clients and capture trades with greater efficiency. Success requires re-thinking the entire legacy organization, looking at new ways to combine or expand roles, and reevaluating the skills that are needed on the team.

These ten initiatives in sales, trading, and operations, can help management streamline the Equities organization for greater top line revenue and increased operating leverage:

- Recast “Research Sales” for delivery of all products and firm resources

- Create “Execution Sales” to maximize trade capture across products

- Rebalance Coverage Assignments to foster team selling for client wallet capture

- Fortify Multi-Product Marketing to maximize product penetration and client wallet share

- Deploy Sector Specialists to generate alpha and raise internal market intelligence

- Implement a Central Risk Desk to consolidate position management and client coverage

- Merge Secured Funding Activity to manage collateral funding and risk

- Centralize Structured Products to eliminate redundancy and internal conflict

- Reengineer Client Integration for speed and control of non-market risks

- Normalize Client Service to eliminate duplicate processes and improve client experience

Finding New Revenue Opportunities

[part of a series on hedge fund sales coverage]

Existing client revenues may be sustained or even increased in a bull market, but a firm stands a better chance of achieving growth even in bear markets if planning is deliberate and focused on specific opportunities. Fortunately, new revenue opportunities may be found through direct client feedback and some basic marketing.

Sales managers need a minimum amount of useful data that can be acted upon for maximum impact on revenue. A practical client plan must be succinct, easily prepared and easily understood. The planning must be done by the salespeople who know the client best, but supported by data and standards for comparison. Many client planning processes either have too little data or become frustrated in their attempts to collect too much detail. At one extreme, plans based on salesperson intuition are not robust and may be clouded by incentives. At the other extreme, it is impossible to collect precise data from clients who are unwilling to disclose the details of their product utilization or spending to the broker community as a whole. Industry-wide surveys and fee pools may be directionally useful but are not specific enough to optimize the unique relationship between an individual broker and client.

Developing Client Plans

In our experience, a basic but useful client plan consist of three items: an organization chart of the client at the fund level, a budget showing revenue expectation at the product level), and one or more action items required to achieve the budget.

At a minimum, an organization chart for an institutional investor should indicate:

- assets under management (using size as a rough proxy for revenue potential)

- allocation of assets among various investment strategies (using strategy as an indicator of product and resource needs)

- decision makers for each strategy (to identify whom to target for relationship building)

It is best to ask the client directly rather than to rely on assumptions that may be incorrect or incomplete. A map of the client organization can expose any misconceptions regarding their investment activity and lead to the discovery of new revenue opportunities. For example, a convertible bond salesperson may not register that the client also has a distressed equity fund until the salesperson is asked to map the entire client organization. The investment strategies used by the client immediately suggest product utilization, which can be confirmed in subsequent discussions with the client. Existing relationships can provide the introductions needed to open up new trading lines. Simply “connecting the dots” in this way does not require elaborate planning and can yield immediate results.

The next step is to identify potential for revenue improvement. We suggest that detailed knowledge of a client’s wallet are not necessary to manage a successful sales effort. Instead, only a few key pieces of information are needed, and these may be readily extracted from the clients themselves:

- What is the firm’s rank with the client? For each product the client trades (i.e., single stock cash), where does the client currently rank the firm? #1? Top 3? Top 5? First tier? Second tier? Allow the client to define the way they rank their brokers.

- Is it possible for the firm to do better? (i.e., move up in the client’s ranking).

- If so, what would be required? Ask the client what actions it will take for the firm to move up. This can be anything from senior management attention, more outgoing calls from analysts, changing sales coverage, or raising capital. These become the action items.

- What would it be worth to the firm? Ask the client to estimate the incremental revenue opportunity to the firm in each product if the the actions are taken. The sum of historical revenues plus these incremental amounts becomes the client budget.

The questions may be posed by sales people or independent persons or who are not conflicted over critical feedback. It is in the interest of the client to answer these questions, as they seek honest feedback and express a willingness to improve. Once the feedback is provided, an implicit contract is created between the client and the firm that if requirements are met, revenues will follow. It is equally important to find out if the client intends to reduce product trading, or if there is no way for the firm to do better.

When combined with historical revenues, the answers to these questions comprise a business plan for the client: prior revenues (reflected in the initial segmentation) may be adjusted by the amounts indicated by the client as potential increases or expected decreases. The plan must also document the actions or resources needed to achieve the budget. Clients with greater potential for increased revenues may receive higher tiering in the next iteration of client segmentation than suggested by their historical revenues alone.

Marketing From a Product Perspective

While the interview process seeks to uncover opportunities from a client perspective, a product-driven process can yield additional results. Each product area should have its own view of the client base that covers existing clients as well as prospects, and the priorities of the product areas can be represented in the segmentation discussion. A two-pronged analysis that covers the market from both client and product perspectives leads to a more thorough capture of opportunities. The matrix approach also improves governance.

The “product walk-across” report is very powerful for highlighting new revenue opportunities arising from introducing a client to additional products. Some opportunities are suggested by gaps in expected trading patterns: for example, hedge funds that trade ETFs may be candidates to trade index swaps; clients who trade cash and options in the U.S. but cash only in Europe are candidates to trade European options; clients who trade cash electronically may also be candidates to trade options the same way; macro investors who trade futures may be candidates to trade ETFs. Products that are similar or interchangeable may be new to the client or simply traded with another broker.

Product marketing is a process of identifying target clients and managing a concerted effort or “campaign” to introduce the targets to the product. Product marketers can identify candidates from gaps in the multi-product revenue report, and also draw from anecdotal market information and industry surveys that highlight clients who are known to trade in specific products with other brokers.

Clients are more likely to try a new product if it solves a problem for them. The product on its own merits may be undifferentiated, but the broker may be able to add value by identifying an application for the product in the client’s portfolio. Solutions-based marketing creates “demand-pull” which can superior to “product-push” in stimulating or accelerating product utilization. Clients are also more likely to take a meeting on portfolio themes than product presentations. Common thematic campaigns include risk management and hedging, emerging markets access, and tax efficiency.

The opportunities uncovered though product marketing may be cross-referenced and added to the client plans. The product-driven effort may reinforce findings from client interviews, but should also find potential opportunities that the client itself may not have recognized, as well as identifying clients who are not otherwise covered by existing relationships.

Client Segmentation 1: Protecting Revenues

[part of a series on hedge fund sales coverage]

Broker-dealers need economies of scale and operating leverage from their client businesses in order to grow. Covering a large number of clients is therefore an exercise in mass customization: each client must feel well-served as to its individual needs; however, the broker-dealer must find solutions that accommodate multiple clients without increasing costs.

Segmentation is the process of sorting clients into groups with similar characteristics. By grouping clients, product and service bundles may be designed and delivered to the clients that are best served by them. Segmentation can also incorporate a hierarchy that establishes the priority or importance of the client to the business and the corresponding value proposition that the client will receive. A tiered segmentation is particularly useful when allocating scarce resources among the entire client base.

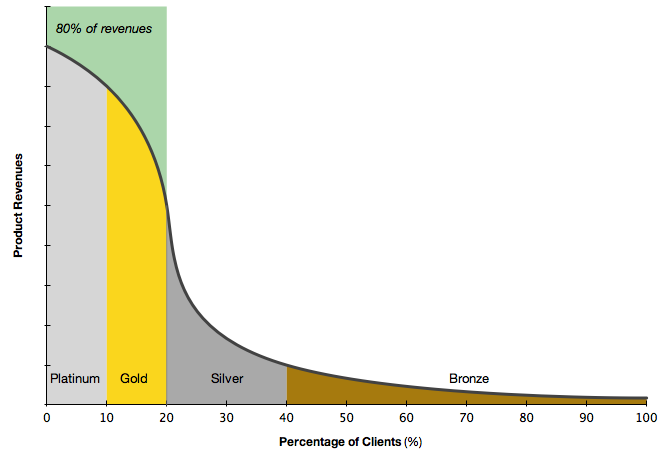

The hierarchy of precious metals shown in Figure 1 is a useful segmentation that is easy for a sales team to remember and act on. Segmentation requires action or it is little more than a sorted list of clients: Clients must be monitored over time and promoted or demoted through the hierarchy to maximize revenues and return on invested resources.

1st Iteration

A good place to begin segmentation is product revenue, so that the business delivers the appropriate resources to existing clients and increases the probability that these revenue streams will continue. Segmentation by historical revenue alone is a defensive approach that protects existing revenues and may induce existing clients to pay more. Once the initial segmentation is established it can be refined into an offensive tool to help capture entirely new clients and sources of revenue.

Product Scope

The first decision to be made is the scope of products included in the revenue analysis. The product revenues define the the client universe by including all active clients who trade the respective products. Inactive and potential clients are not captured at this point but will be added in future iterations of the segmentation.

Products are the payment mechanism for clients. Measurement of revenue in a single product may not be sufficient to capture a client’s entire “wallet” or product utilization and payment patterns. Therefore, the products that comprise as much of any client’s wallet as possible should be included in the analysis. For an institutional equity business, we suggest capturing revenues in the following product “buckets”:

- Cash: single stock

- Cash: programs

- Cash: electronic

- Cash: new issue

- Derivatives: convertible bonds

- Derivatives: OTC options

- Derivatives: listed options

- Derivatives: ETFs

- Derivatives: structured notes

- Derivatives: futures (execution)

- Financing: prime brokerage (margin, clearing, stock loan)

- Financing: OTC total return swaps (other delta-one)

Too much granularity in product definitions can diminish the effectiveness of the analysis. However, it can be useful to distinguish product revenue by currency (to see behavior across regions), to break-down electronic execution to include derivatives, and to separate clearing from margin and stock lending (particularly for listed derivatives). The marketing value of this information becomes obvious once the team begins to analyze client behaviors.

Revenue Reporting

For each product it is useful to collect client-level revenue for the prior full-year, and for the current year-to-date, which may be annualized for comparison. Trailing 12-month revenue may be a more recent full-year measure, but discrete timeframes like calendar years are helpful for observing trends. If capital facilitation in cash or derivatives trading is included in the client value proposition, it is helpful to report top line revenues as well as net revenues after losses from client positions.

The report of product revenues by client can reflect all of this data as changes in revenue over time. For example, client revenues in a specific product that have declined more than 5% below the prior year may be shown in red, while clients showing a run rate greater than 5% above the prior year may be shown in green. A single report that reflects absolute revenues as well as trends leads to more efficient review of how clients are responding to their respective resource allocation.

The report of product revenues by client is sometimes referred to as a “product walk-across,” as in walking across the firm’s products to see a full picture of a client’s activity. Designed to drive the segmentation and resource allocation processes, the report of product revenue by client is a powerful management tool that can be used to review different groups of clients. For example, the report may be used to analyze clients of a certain type or strategy; clients in a particular geographic region; clients assigned to a specific sales person; or, clients targeted by a specific product group. This single report, run against different groups of clients, is the single most important tool for managing a sales force. For the initial cut at segmentation, all clients with revenue attribution are included.

The “80-20 Rule”

In the pool of over 1,500 institutional investors in the U.S., most full-service banks or broker-dealers earn 80% of their top-line revenue from approximately 20% of the largest hedge funds and traditional asset managers, or a total of approximately 300 clients, a manageable number for periodic, meaningful review.

The tail can be very long, consisting of over 1,200 clients that must be continually mined for prospects in which to invest. A key decision remains to either ignore the rest or find a “no-touch” service model, relying on technology rather than humans for service, and allocating only resources that are scalable rather than scarce. A low-cost coverage strategy for smaller clients can provide early access to fast-growing clients, as well as low sensitivity to clients that fail.

For a large, full-service institutional Americas equity business, this framework could result in the following segmentation (shown in figure 2):

- Platinum: the top ten percent of clients, generally “house” accounts, often paying in multiple products or paying so much to one product that they are entitled to firm-wide resources (annual revenues > $10mm)

- Gold: the next ten percent (11th-20th revenue percentile) of clients ($2mm < revenues < $10mm), representing nearly 80% of total revenues for the product universe

- Silver: the next twenty percent of accounts (21st-30th revenue percentile), which may be smaller accounts or those trading in fewer products ($500m < revenues < $2mm)

- Bronze: all remaining clients, often receiving no resources or coverage from scalable “one-touch” or “no-touch” platforms, and allocation of scalable rather than scarce resources

The next step in deploying the client segmentation is to assign the correct value proposition to each segment. The value proposition is an investment in the client, made in the expectation that the client will respond favorably. In some cases, maintaining current revenue is an acceptable outcome, but growth in the business is dependent upon clients responding with additional revenue.

The first iteration of client segmentation and resource allocation based on historical revenues does not reflect any information about new or incremental sources of revenue. A better profile of existing and prospective clients is needed to understand their ability to pay and the factors that influence their behavior. This data can then be used to enrich the process and drive revenue growth.

Hedge Fund Coverage

Our recent post on Team Selling as an alternative to cross-selling prompts a larger series on hedge fund coverage. In future blog posts, we will provide some proven techniques for managing complex institutional investor clients across multiple product areas of a bank or broker-dealer. While these techniques have been applied successfully in a global institutional equity business, they may be extended to fixed income or other multi-product businesses that serve the same client.

UPDATE: High Line Advisors has published an article on this topic. Hedge Fund Coverage: Managing Clients Across Multiple Products is available upon request.

Rules of Prime Brokerage Risk Management

We’ve assembled a list of guiding principals for managing risk in a prime brokerage business, covering the areas where prime brokers are most likely to get into trouble. We encourage the community to contribute to or debate this list. Anonymous contributions may be emailed to feedback@highlineadvisors.com.

- Margin Lending: Don’t finance what you don’t trade. If you don’t have price discovery or can’t orchestrate a liquidation of the collateral, don’t make the loan.

- Margin Lending: Lend against assets, not credit. The ability to value collateral should be a core competency of any prime broker or repo desk, while expertise in credit extension (unsecured lending) is not. Be aware of the boundary between secured and unsecured risk, as lower margin buffers increase credit exposure in extreme (multi-sigma) market events. If you don’t have possession (custody) of the asset, don’t finance it.

- Margin Lending: Finance portfolios, not positions. Diversification of collateral is a significant risk mitigator.

- Margin Lending: Accept everything as collateral, but don’t necessarily lend against it. Cover your tail risk with a lien on anything you can get, but don’t add to the problem by lending against less liquid positions.

- Margin Lending: Be aware (beware) of crowded trades. The liquidity assumptions used to determine margins may be insufficient when like-minded hedge funds simultaneously become sellers of the stock. This goes beyond positions in custody, but those held by other prime brokers as well. Ownership representations are reasonably required.

- Secured Funding: Eliminate arbitrage among similar products. Maintain consistent pricing and contractual terms when borrowing securities or entering into swaps, repos, margin loans, or OTC option combinations with customers.

- Customer Collateral: Accept only cash collateral for derivatives. If non-cash collateral is offered, convert it to cash (via repo), apply only the cash value against the requirement, and charge for the cost of the conversion. Cash debits and credits are the best way to manage margin/collateral requirements across multiple products and legal entities.

- Contractual Terms: Treat clients that do not permit cross-default or cross-collateralization among accounts as if they were as many distinct clients. If you can’t net or offset client obligations, don’t give margin relief for diversification.

- Derivatives Intermediation: Do not provide credit intermediation unless you understand credit risk (again, most prime brokers do not) and charge accordingly. When intermediating derivatives operations, do not inadvertently insulate customers from the credit of their chosen counterparties.

- Funding Sources: Raise cash from collateral, not corporate Treasury. Strive to be self-funding, raising cash lent to customers from securities pledged by customers. Practice “agency” lending (from cash raised from customer collateral) over “principal” lending (from unsecured sources of cash, like commercial paper).

- Term Funding Commitments: Don’t be the lender of last resort unless you understand what it means, want to do it, and get paid properly for it. Only the largest banks with substantial cash positions under the most dire circumstances may be in a position to offer unconditional term funding commitments. Does any broker-dealer qualify?

- Sponsored Access: Have robust controls for high-frequency direct market access, including gateways to enforce trading limits.

Learning From The Past

“A good scare is worth more to a man than good advice.” — Edgar Watson Howe

“That which does not kill us makes us stronger.” — Friedrich Nietzsche

- The self-liquidation of Amaranth Advisors at the end of 2006 was the canary in the coal mine, exposing the difficulty of managing complex customer activity in multiple markets and asset classes, expressed through listed products and OTC contracts in multiple legal entities. Firms had an inadequate picture of aggregate client activity and were uncertain of their contractual rights across the different products. This confusion slowed the movement of cash, creating cracks in the client-broker relationship. Losses at banks were averted solely because of the high degree of liquidity in Amaranth’s portfolio. The crucial question that would haunt banks in the coming months was: what if Amaranth’s remaining positions could not have been sold to raise cash?

- Several hedge funds, most notably those of Bear Stearns Asset Management, began to default on payments in 2007. Unable to raise cash from increasingly illiquid investments, both investors and banks lost money. The defaults drew attention to financing transactions in which the banks did not have sufficient collateral to cover loans they had extended. It is noteworthy that these trades were not governed by margin policy in prime brokerage, but were executed as repurchase agreements in fixed income, in some cases with no haircut or initial margin. Collateralized lending was practiced inconsistently by different divisions of the same firm, some ignoring collateral altogether and venturing into credit extension.

- The collapse and sale of the remainder of Bear Stearns in early 2008 highlighted a different liquidity problem: a case in which customer cash held in prime brokerage accounts (“free credits”) significantly exceeded the firm’s own cash position. Because of this imbalance, Bear Stearns was essentially undermined by its own clients as hedge funds withdrew their cash. Once the customer cash was gone, the firm could not replace it fast enough from secured or unsecured sources of its own. Bear Stearns’ predicament forced the prime brokerage industry to confront some hard truths: Because firms had developed a dependency on customer cash and securities in the management of their own balance sheets, sources of cash and their stability were not fully understood even by corporate treasuries.

- The bankruptcy of Lehman Brothers in September of 2008 exposed the widespread practice of financing an illiquid balance sheet in a decentralized manner with short-term liabilities. Under the assumption that the world was awash in liquidity and ready cash, many firms had neither the systems to manage daily cash balances nor contingencies in the event that short-term funding sources became scarce. The problems of Lehman and its investors were compounded by intra-company transfers and cash trapped in various legal entities.

- The Madoff scandal that broke the following December was in some ways the last straw for asset owners. Already concerned about the health of the banking system and the idiosyncratic risk of fund selection, they lost confidence in the industry’s infrastructure and controls. Banks now contend with demand for greater asset protection and transparency of information.

In summary, the actions suggested by these five events are as follows:

- Aggregate the activities of any one client across all products and legal entities of the bank or broker-dealer

- Establish consistent secured lending guidelines across similar products to ensure liquidity

- Develop transparency of all sources and uses of cash to minimize reliance on unsecured funding [see Collateral Management: Best Practices for Broker-Dealers]

- Match assets and liabilities to term

- Prepare for segregation of customer collateral with operations, reporting, and alternative funding sources

The “Clearing” Broker vs. The “Prime” Broker

We are often questioned on the definition of “prime brokerage.” The various names by which banks and broker-dealers label a collection of products and services (prime services, prime finance, equity financing and services, etc.) hint at the fact that there is little consistency among market participants. The scope of such business units variously includes or excludes execution, clearing, and/or financing of physical securities (equity and fixed income), OTC derivatives, and listed futures and options. Inconsistency makes it difficult for regulators to measure and for managers to benchmark themselves to competitors.

In the article entitled The Future of Prime Brokerage, we suggested that prime brokerage could be defined as the center of both client service and secured funding for a bank or broker-dealer. With stock loan, margin lending, and total return swaps all essentially exchanging equity securities for cash or vice-versa, consolidating the management of these secured funding transactions (along with equity repo, forwards, and high-delta options and option combinations) minimizes risks and optimizes the balance sheet. We also suggested that this concept can be extended beyond the equity asset class into liquid fixed income securities that are financed via comparable instruments (usually repo).

We also argued that prime brokerage can be the consolidation point for client activity across the bank or broker-dealer, thereby facilitating reporting, portfolio-level financing, and consolidated margin. In so doing, prime brokerage provides the single point of post-trade client service for all institutional investors.

Prime brokers generally do the clearing for trades that they accept from executing brokers on behalf of their clients. The scope of the prime brokerage relationship is defined by the set of products that the prime broker can clear. At a minimum, prime brokers clear cash equity trades themselves (“self-clearing”) rather than relying on a correspondent. Many prime brokers also accept listed equity derivatives, which gives their clients more flexibility and convenience. Some primes (such as NewEdge) emphasize clearing of listed derivatives.

The enactment of the Dodd-Frank legislation in the US has brought focus on the clearing of listed derivatives. The management of listed futures and options clearing within banks and broker-dealers varies, which may affect the product scope of the prime brokerage offering at a bank or broker-dealer:

- Alignment with institutional equities builds on the core knowledge of exchange mechanics and electronic trading in the equities business;

- fragmentation by asset class puts profit and loss from various contracts into the related product area, e.g. revenue from interest rate futures booked into the rates business and from equity index futures into the equities business;

- management as a stand-alone business line (including execution and clearing) due to the unique nature of listed derivatives and their risk and collateral requirements over the life of the contracts;

- alignment with traditional prime brokerage businesses, for management of portfolios using listed derivatives for risk mitigation and serving firms who borrow securities and cash in support of market-making activities.

As banks and broker-dealers seek to optimize their respective balance sheets and capital requirements, just as institutional investors will seek portfolio-level margin and consolidated service and reporting, the distinction between the “prime” broker and the “clearing” broker may vanish. With more products moving to exchanges or central counterparties (CCPs), centralized optimization of the bank or broker-dealer’s funding in the context of CCP requirements and heightened controls over customer collateral is critical.

We advocate the management of clearing activity for all trading products within the prime brokerage or prime “services” operation. The definition of “prime brokerage” then extends to three specific utilities across global markets:

- Securities finance

- Client service

- Clearing

Of these functions, securities finance compliments a sales and trading (execution) business in the related securities, usually equities. Similarly, clearing compliments an execution business in listed derivatives. Among various banks and broker-dealers globally, players may emphasize one or the other, or both lines of business. For example, European banks operating in the US may be significant players in listed derivatives but not in cash equities, favoring a prime brokerage business built on clearing. Smaller broker-dealers may deal in cash equities but not derivatives. With a smaller balance sheet, such broker-dealers may emphasize the client service aspect of prime brokerage and source financing for their customers in the wholesale markets. The largest banks may have the largest scope, serving clients active in cash as well as derivatives, from execution through to clearing and custody.

When should execution as well as clearing, custody, and secured financing be a part of prime brokerage? We would suggest that when financing of an asset is the primary component of setting price (spread) and margin (haircuts), then the execution component of the product is a candidate for integration with prime brokerage in order to apply common practices for secured lending transactions. Incorporation of execution functions may be difficult for prime brokerage businesses built on post-trade margin financing, just as it may be difficult for fixed income repo or equity derivatives trading desks to appreciate the commonalities of their products with margin and securities lending.

If prime brokerage is used as a firm-wide utility and not as part of a product silo, broader linkages to execution services (defined by electronic trading tools, exchange connectivity, and clearing) allow for straight-through-processing and better operating leverage for banks and broker-dealers. By increasing the number of products that a covered by clearing, financing, and reporting, the prime broker will have a more complete value proposition for asset managers and a greater ability to manage collateral and risk exposures.

A final note on the distinction between the clearing “function” and the clearing “platforms” at a bank or broker-dealer. The clearing “function” is performed on behalf of trading clients and may require financing (the lending of cash and/or securities) to facilitate settlement, either of which are a natural fit within prime brokerage. The clearing “platforms” are the technologies on which the clearing is done. The management (maintenance and operations) of the platforms may be performed outside of prime brokerage, such as within the GTS business of Citi, or the TTS business of JP Morgan. In these instances, the platforms may be used by the firm’s own global markets businesses as well as offered to the firm’s other clients, who may be broker-dealers themselves.