Posts Tagged ‘stock loan’

Clearstream GSF 2012

Clearstream Global Securities Finance Summit 2012

Market Observers’ Panel, Luxembourg, 18 January 2012

Remarks made by: Jeff Penney, Senior Advisor, McKinsey & Company

Introduction

As the first “market observer” on this panel, I’d like to give an overview of the current state of funding activity, primarily from a US perspective.

For me, four questions frame the issues for our panel:

- How can lenders be certain to get their cash back, despite weakened borrowers?

- How can banks achieve better capital efficiency despite more stringent requirements?

- How can collateral be expanded in illiquid markets? And finally,

- How can regulators get the transparency they need?

These are not trick questions. But they may share a common answer.

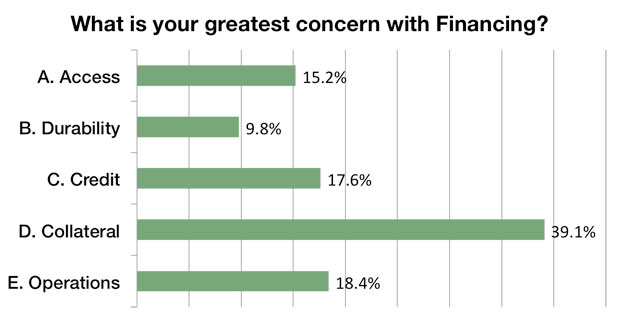

Audience question #1.

I’d like to begin by putting a question to the audience. Most everyone here is involved in securities finance as a borrower, lender, regulator, or industry observer like those of us on this panel. The question is: what is your primary concern with financing? I give you five possible answers:

- Access (the availability of cash)

- Durability (the term, reliability or stability of funding)

- Credit (of the borrower, or the agent lender or triparty custodian)

- Collateral (its form, liquidity, haircuts, or rehypothecation)

- Operational risks (valuation, collateral substitution, or timing)

Most of the concerns we’ve just listed are present in the system of financing we have today. The securities funding transactions we rely on are collectively referred to as the “shadow banking system,” a term that casts a negative light on the markets. It may be bad news to some that the shadow banking system is not going away. The good news is it can be made far safer than it is today.The shadow banking system is not going away.

Part of the concern about shadow banking is that it is not well understood. In a paper published just over a year ago entitled “Regulating the Shadow Banking System,” Gary Gorton and Andrew Metrick of Yale University provide a useful definition of “the main institutions of shadow banking:

- money-market mutual funds to capture retail deposits from traditional banks,

- securitization to move assets of traditional banks off their balance sheets, and

- repurchase agreements (“repo”) that facilitate the use of [collateral] in financial transactions as a form of money.”

Even if securitization activity is muted, money market mutual funds and the repo market are deeply embedded in our financial system and critical to its functioning.

Use of the term “shadow banking” has evolved since the financial crisis. Lately, it’s being used by banks to label high margin businesses such as securitization and direct lending that banks fear losing to unregulated entities like hedge funds.

This situation should not deter us from making improvements to the money markets. Secured lending is the means by which people with cash to invest, including individuals in retail mutual funds, look for returns by making short-term, collateralized loans.

Secured funding is not so secure anymore.

Unfortunately, market participants think that “secured funding” is not so secure anymore.

Before I became an advisor, I managed an equity finance and prime brokerage business. In managing risk, my first rule was to never finance something I did not trade. Because when a borrower defaulted, the only way to get the bank’s cash back was to liquidate the collateral that was pledged to secure the loan.

If you are comfortable with the collateral and the haircuts you’ve applied, you don’t care as much about the credit of your borrower or counterparty. The problem is that most lenders are NOT comfortable with collateral, and feel much more exposed to the credit of the borrower and its ability to return the lender’s cash.

Credit concerns persist.

Concern about credit is at the core of the liquidity crisis today. No one wants to make a loan that will be paid back with collateral rather than cash. The inability to trade collateral — not knowing what its worth or where to sell it — means the lender is exposed to the credit of the borrower.

Professor Gorton uses the term “information insensitive” to describe the type of collateral that is most attractive for securing loans. If the collateral is well understood and no market participants have an information advantage over others, lenders can be more confident that they will get their cash back.

Government securities used to be the best collateral, with the least sensitivity to information. Mortgage securities became “information sensitive” during the financial crisis, and hence were no longer accepted as collateral. Today, sovereign bonds have become “information sensitive,” and their value as collateral has been impaired. (I highly recommend Gary’s book, “Slapped by the Invisible Hand” as a walk through the valley of shadow banking.)

When the collateral isn’t good enough and the credit rating of the borrower is weak, cash lenders withdraw from the system. This is the slow-motion “run on the banks” we are currently experiencing.

A growing number of market participants will protect themselves by withholding their cash. For example, US mutual funds have reduced exposure to European banks and sovereigns, putting pressure on dollar funding and forcing Europe’s central banks to intervene further.

In the repo market, lenders are still able to single out individual borrowers and cut off their sources of funding, even when those same borrowers have adequate collateral to post. This situation occurred very recently after the failure of MF Global. Access to liquidity is once again the critical concern of banks and broker-dealers.

Liquidity concerns now outweigh capital adequacy.

So much regulation has been concerned with capital adequacy rather than liquidity. Felix Salmon of Reuters, in his blog entry of November 25, 2011, put it quite concisely:

“Give an insolvent bank enough liquidity, and it can live indefinitely. Remove liquidity from a bank, and it dies immediately, no matter how solvent it might be or how high its capital ratios are.”

Despite the early focus of legislation on capital, regulators seem to be turning their attentions to the liquidity problems facing banks and broker-dealers.

The US repo market has far to go.

The US market itself has far to go in terms of improvement. Everyone here is no doubt aware that in May of 2010, the Federal Reserve Bank of New York authored a white paper on the tri-party repo system and convened a task force to address a number of concerns raised in that document. The taskforce has not disbanded, but may have reached reasonable limits of its ability to address the regulator’s concerns.

On a positive note, the taskforce developed a 13-point confirmation matching process that has reduced trade breaks. Perhaps the most important achievement was agreement to eliminate the unwind process in longer-dated repos, allowing for collateral substitution rather than a complete termination and restarting of the transaction. The taskforce also sped up the timing of trade allocations.

Some critical concerns of the regulator remain unaddressed. The most important issue is intraday credit exposure borne by the tri-party banks on new transactions. Another concern raised by the regulators is the “pro-cyclicality” of collateral. Pro-cyclicality points to changes in the value of collateral over time, and the unreliability of static haircut schedules. In fact, the regulator suggests that static schedules led to substantial over-leverage, particularly on certain types of collateral that was not eligible for funding directly from the central bank.

One option of the regulator is to limit the forms of collateral in the tri-party system, which would be very disruptive. Better to find a robust solution that increases, rather than decreases, the acceptable forms of collateral.

Cleared repo is a viable solution.

A successful repo solution will have to do three things.

- First, each item of collateral must be evaluated independently rather than relying on haircut schedules. This approach requires an understanding of the liquidity and volatility characteristics of each individual collateral security.

- Second, there must be robust procedures for the liquidation of collateral and return of cash to lenders.

- Third, collateral substitution should be used in place of rehypothecation to minimize intraday credit exposure. The agent bank should release cash or collateral only as other collateral comes in. To give borrowers and lenders adequate flexibility, the systems must support multiple intraday settlements, rather than one large settlement at the end of the day.

Tri-party repo reform will never address the risk of a run on any single bank or broker dealer that can occur in a bilateral, OTC system. As a practical matter, the new technology required to support these three issues (security-level valuation of collateral, liquidation mechanics, and intraday settlement of substitutions) will take years, given the pressure on bank earnings and other compliance requirements.

The next question is whether renovation of the tri-party system is really the answer, or whether we should introduce an entirely new architecture based on central clearing.

A central counterparty clearinghouse for repo, or CCP, solves these problems. The European model has proven this theory in recent weeks, as US borrowers cited cleared repo in Europe as their most reliable source of funding when they were excluded from the bilateral system in the US on the basis of their perceived credit rather than their collateral.

Capital efficiency can be achieved through a CCP.

When liquidity is stabilized by a CCP, we can turn our attention to capital efficiency. Bank capital is under increasing pressure from regulation, and banks are concerned a CCP will raise collateral requirements, adding to the squeeze on capital.

This fear may be justified in the short term, but in the long run, CCPs can provide capital efficiency in the form of margin relief, if they clear the right combination of products.

No CCP risk manager will provide margin relief across asset classes. The correlations, volatility, and liquidity characteristics are not reliably predictable. And, diversification as a risk reduction strategy has limited value in today’s markets.

Margin relief is only possible from offsetting positions in the same security. The most directly offsetting trade combinations are a derivative and the transaction that funds it. When the funding trade ends and its collateral can be used to settle the derivative at maturity, the risk in the transaction is reduced dramatically.

In an example provided by the Options Clearing Corporation (OCC), the net margin requirement for government bond repo plus a short interest rate futures position of comparable maturity would be 70% smaller than if the two trades were margined separately. The lower margin requirement is made possible because the bond can be delivered into the futures settlement.

A cleared repo solution can drive margin requirements down when it shares a CCP with the related derivative products. This is the fundamental reason that banks should support putting more, not less, into central clearing.

Collateral can be expanded to include equities.

I serve on the Advisory Board for Quadriserv in the US, where we’ve found another opportunity for margin relief: specifically, when a position in equity options is hedged with stock borrowed through the same CCP. The margin requirement for the two positions combined is dramatically lower than for the options position and stock loan viewed separately.

Where funding is concerned, there is no difference economically between an equity repo and a stock loan transaction. Financing of bonds as well as equities can be served by the same solution.

The closing of SecFinEx has raised questions about whether a CCP model for stock loan can succeed in the US. In contrast with Europe, the US has the advantage of a single currency, one CCP, and one settlement processor in DTCC.

It now appears that the major leap forward in equity finance will not come from changes to customer stock loan, but from the expansion of equity repo among dealers. It is interesting that a solution intended for stock borrowers can also help cash borrowers, but the immediate need for interbank funding is more likely to drive the success of a CCP for equity finance than stock loan market reform. While market participants have resisted change to tri-party repo and stock loan conventions, the prospect of funding equities through a CCP has generated a more enthusiastic response.

Collateral Expansion

Collateral can only be expanded if it is “information insensitive” and fungible. Different collateral securities can become equivalent by applying the appropriate haircut to each individual security. In this scenario, CUSIP or security-level risk management is required not only to set haircuts as a function of liquidity and volatility, but also to liquidate securities.

A CCP with security-level risk management can handle bonds and equities alike. Ultimately, linkages between CCPs can allow for collateral to be moved in support of obligations in other markets, asset classes, and currencies. This is the ultimate vision of cleared financing.

Summary

In summary, I’ll return to the four questions I posed at the top:

- First, How can lenders be certain to get their cash back, despite weakened borrowers? A CCP can guarantee the return of cash and provide an anonymous platform for borrowers who produce adequate collateral.

- Second, How can banks achieve better capital efficiency despite higher requirements? Capturing financing along with related derivatives within CCPs allows for dramatic margin relief and return of capital.

- Third, How can collateral be expanded in illiquid markets? Rather than relying on schedules, central risk management that applies haircuts to individual collateral securities can pave the way for CCP-based equity repo as a compliment to the current systems.

- And finally, How can regulators get the transparency they need? To my mind, there’s one answer for all four of these questions: CCPs provide a single point of contact for regulators to evaluate the number of transactions, the parties engaged in them, and the adequacy of the collateral pool. The CCP also provides a focal point for central bank support, should it become necessary.

Perhaps most exciting for the future of our industry is the vision for CCPs to connect across border to meet the needs of borrows for cash and lenders for secure returns.